what percentage of taxes are taken out of my paycheck in ohio

Before the official 2022 Ohio income tax rates are released provisional 2022 tax rates are based on Ohios 2021 income tax brackets. Ohio local income taxes which are referred to unofficially as the RITA Tax range from 05 to 275.

Tax Ohio Fill Out Sign Online Dochub

Ohioans pay state-level income tax ranging from 0 to 399 depending on their taxable incomes.

. Every employee is taxed at 62 percent for Social Security and 145 percent for Medicare. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly. 8 reviews of Avellas Italian Take Out A very welcome addition to Middletown.

Similarly Ohios statewide sales. Total income taxes paid. The food is as advertised take-out but they.

This works out to be 4750. You pay the tax on only the first 147000 of. For all the Italians we have here we dont have too many places to get a good Italian sandwich or side dish.

FICA stands for Federal Insurance Contributions Act and is a US. Lansing MI 48911 517. Amount taken out of an average biweekly paycheck.

According to the Ontario tax rates for 2021 the amount earned up to 45142 is taxed at a rate of 5. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. If you make 70000 a year living in the region of Ohio USA you will be taxed 10957.

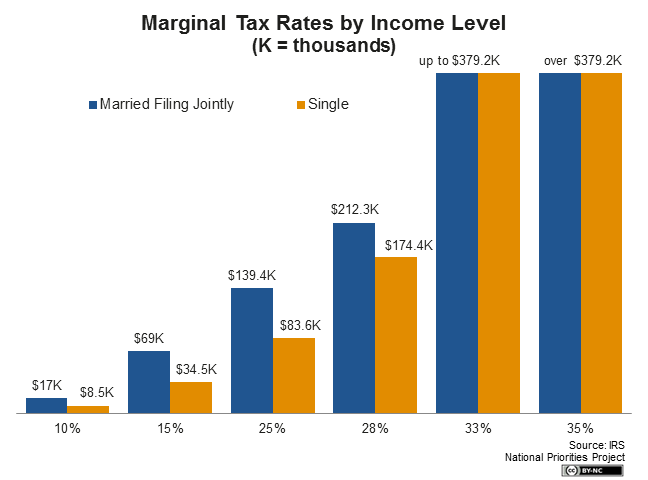

Your average tax rate is 1198 and your marginal tax rate is 22. Ohio Income Tax Calculator 2021. For a single employee paid weekly with taxable income of 500 the federal income tax in 2019 is 1870 plus 12 percent of the amount over 260.

The bonus tax calculator is. These amounts are calculated and deducted from earnings after all pre-tax. Alone that would place Ohio at the lower end of states with an income tax but many Ohio municipalities also charge income taxes some as high as 3.

Ohio Hourly Paycheck Calculator. The 2022 state personal income tax brackets are updated. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

18 reviews of Joes Take-Out Joes Take-Out is tucked away on the side of the Harris Teeter shopping center where the Papa Johns used to be. Lansing Catholic knocks undefeated Durand out of playoffs. If no tax is being withheld please provide us with the facts in writing and include a copy of your most recent W-2 or paystub and submit this to the Ohio Department of Taxation Employer.

The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. How Much Tax Is Deducted From My Paycheck Ontario 2021. Ohio State Unemployment Insurance SUI As an employer youre.

FICA taxes consist of Social Security and Medicare taxes. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings for a. Amount taken out of an average biweekly.

FICA taxes are commonly called the payroll tax. What is the percentage that is taken out of a paycheck. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

How much do you make after taxes in Ohio. Whats the tax rate on a paycheck in Ohio. However they dont include all taxes related to payroll.

What taxes do Ohioans pay.

Ohio Department Of Taxation S Casino Training Ppt Download

Ohio To Adjust Income Tax Withholding In 2019 The Blade

New Ohio Tax Conformity Bill Passes Hw Co Cpas Advisors

My First Job Or Part Time Work Department Of Taxation

How Do State And Local Individual Income Taxes Work Tax Policy Center

Oh It 941 Fill Out Tax Template Online

What Is Local Income Tax Types States With Local Income Tax More

A Complete Guide To Ohio Payroll Taxes

Ohio Payroll Tools Tax Rates And Resources Paycheckcity

New Ohio Overtime Pay Rules How Your Paycheck May Be Impacted Wowk 13 News

Things To Know About Wage Garnishment In Ohio Amourgis Associates

Township Taxes Miami Township Oh Official Website

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

Ohio Department Of Taxation S Casino Training Ppt Download

/cloudfront-us-east-1.images.arcpublishing.com/gray/ICQ64HQ7RFMTPBHCIXZXHVINKI.jpg)

Ohio Income Tax Collections Miss Mark Again

Congressman Warren Davidson The Good News Keeps Coming For Ohio Families As The Irs Adjusts Its 2018 Withholding Tables This Month Meaning Fatter February Paychecks Nine Out Of Every Ten